Be alert for serious IRS impersonation scams

At WPF, we get a range of calls and emails from consumers. Usually, it’s me who is assisting a consumer, helping them work through a privacy issue or in some cases, a scam that has rattled them. But today, it is me who has gotten a phone call from a scammer, and it made me think twice. I know that if a scam makes me think twice, then it is dangerous, because I am generally a scam-aware person after hearing about so many of them from consumers.

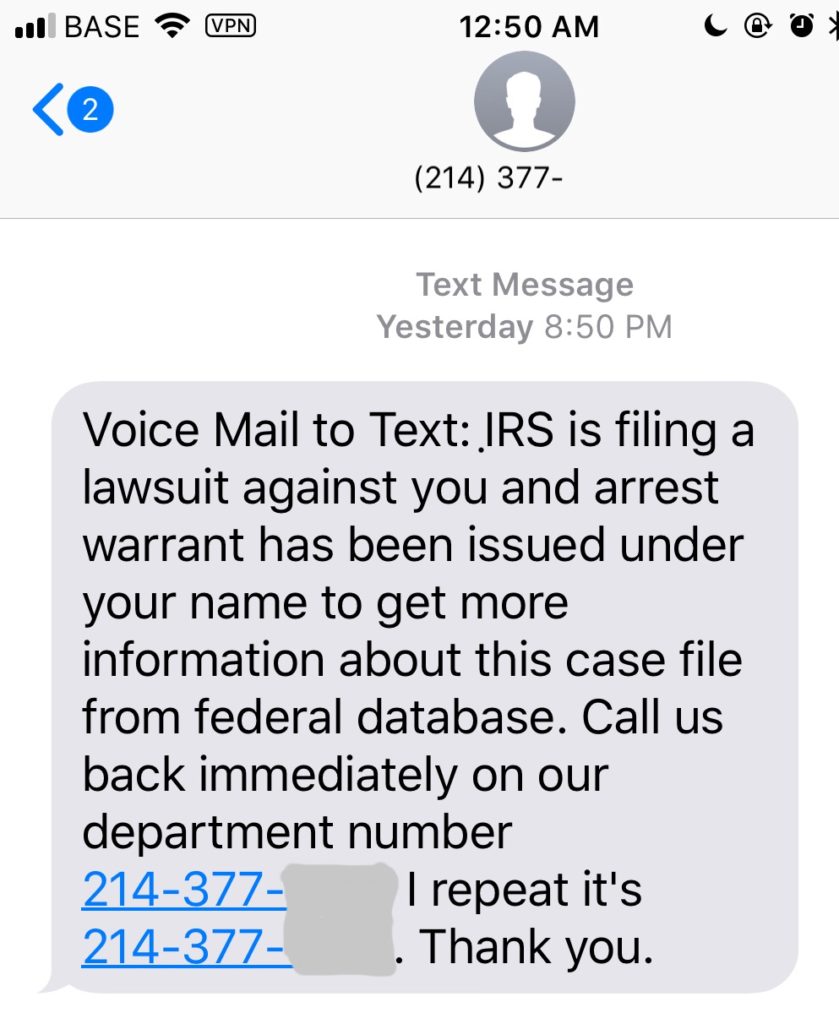

Here is my scam story, and it begins with a scam voicemail that I received: (Note: I edited out the last four digits of the phone number.)

Receiving a call or a message like this — especially at tax season — is a jolt to the system, no matter how experienced you are at spotting scams. The scammers make these calls and send these kinds of messages to push consumers’ hot buttons and push people into complying with their demands. If a consumer is frightened by the scammer, they could fall prey to being bullied into giving the scammer money. If you or someone you love has gotten a message like this, here are some facts to help counter the scam.

The scammer’s goals

The overall intent of this scam is to first frighten consumers and to push their emotional buttons and get them to call that phone number on the screen. After a consumer calls the number, then a skilled and aggressive scammer can talk them into sending money right away to them via a check over the phone, or via a credit card.

In some variations of this scam, the scammer is also gathering information to commit identity theft.

Busting the scam with information and facts

The best way to defeat a scam is to know what is really happening and to know the facts about how the IRS operates, and about how scammers operate.

- First Fact: The IRS will not call you to demand payment.

- Second Fact: The IRS will not call you to threaten to put out an arrest warrant for you in order to collect taxes.

- Third Fact: The number in this message I received appears to be originating in Dallas, Texas. That is suspicious. The IRS phone helpline numbers are posted on its web site, this is not one of them.

- Fourth Fact: The call I received came in at 8:50 pm. This is well outside of business hours, and it is a red flag indicating this is a scam.

- Fifth fact: This message is aggressive and pushy. This is a hallmark of scammers.

Aggressive phone scams are still hurting consumers

According to the IRS, aggressive phone scams are continuing to plague consumers. The IRS categorizes these scams as serious, and I agree.

Here is what the IRS says about phone tax scams, and their advice. This is excerpted from the IRS “dirty dozen” page of tax scams.

The IRS Will Never:

-

Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

-

Threaten to immediately bring in local police or other law-enforcement groups to have the taxpayer arrested for not paying.

-

Demand that taxes be paid without giving taxpayers the opportunity to question or appeal the amount owed.

-

Ask for credit or debit card numbers over the phone.

-

Call you about an unexpected refund.

For Taxpayers Who Don’t Owe Taxes or Don’t Think They Do:

-

Do not give out any information. Hang up immediately.

-

Contact TIGTA to report the call. Use their IRS Impersonation Scam Reporting web page. Alternatively, call 800-366-4484.

-

Report it to the Federal Trade Commission. Use the “FTC Complaint Assistant” on FTC.gov. Please add “IRS Telephone Scam” in the notes.

For Those Who Owe Taxes or Think They Do:

-

Call the IRS at 800-829-1040. IRS workers can help.

You can read the entire scam warning from the IRS here: https://www.irs.gov/newsroom/phone-scams-pose-serious-threat-remain-on-irs-dirty-dozen-list-of-tax-scams.

Getting this tax scam message myself has taught me something about scams: when the scam isn’t directed at you, it’s much easier to be unaffected by it. But when a scam is directed at you, it can be more difficult to step back and take a moment to look at the signs and see the markings of a scam. That stepping back and thinking for a moment is exactly what is most needed when you are faced with a scammer’s message.

No matter what, if you get a phone call from someone saying they are from the IRS, and that person asks you to pay them money over the phone, hang up and block the number. Don’t talk to them, and don’t give them your Social Security Numer, date of birth, or any personal information. If you are worried about your tax status, reach out to your accountant or to the IRS to double check. But don’t get caught on the phone with a scammer.

You can help others by reporting IRS impersonation scams to the Treasury Inspector General via their website https://www.treasury.gov/tigta/contact_report_scam.shtml or their 800 number ( 800-366-4484).

—Pam Dixon